Home Insurance 101: What Every Homeowner Needs to Know

Navigating the complexities of home insurance can be daunting, especially when it comes to understanding what is covered when disaster strikes. In Florida, where hurricanes, tropical storms, and high humidity are common, it is crucial for homeowners to have the right insurance coverage to protect themselves from unexpected damages. Mold Masters, a leader in mold remediation, is here to help you understand the essentials of home insurance and how it can safeguard your property.

Understanding Home Insurance Basics

Home insurance is a type of property insurance that covers losses and damages to an individual's house and assets in the home. It typically provides liability coverage against accidents in the home or on the property. A standard home insurance policy in Florida covers a variety of perils, including fire, storm damage, theft, and certain types of water damage. However, understanding the specifics of your policy is crucial as coverage can vary significantly between providers and policies.

Key Components of Home Insurance Coverage

A comprehensive home insurance policy generally includes several key components:

- Dwelling Coverage: This protects the structure of your home, including walls, roof, and built-in appliances, against covered perils.

- Personal Property Coverage: This covers personal belongings such as furniture, electronics, and clothing if they are stolen or damaged by a covered peril.

- Liability Coverage: Provides protection against legal claims or lawsuits for bodily injury or property damage caused by you or your family members.

- Additional Living Expenses (ALE): If your home is uninhabitable due to a covered loss, ALE covers the cost of living away from home, such as hotel bills and meals.

Understanding these components helps you identify the type of coverage you need and ensures you are adequately protected.

Special Considerations for Florida Homeowners

Florida homeowners face unique challenges due to the state's climate and geography. Hurricanes, tropical storms, and flooding are significant threats that can cause extensive damage to properties. Standard homeowner's insurance often doesn't cover flood damage, making it essential for Florida residents to consider purchasing a separate flood insurance policy.

Additionally, high humidity levels in Florida can lead to mold growth, especially after a water event. While some homeowner policies cover mold damage, coverage is often limited. It's crucial to review your policy's declarations page to understand what's included. Mold Masters can assist you in evaluating your current coverage and help you make informed decisions about additional policies.

Mold Damage and Insurance: What You Need to Know

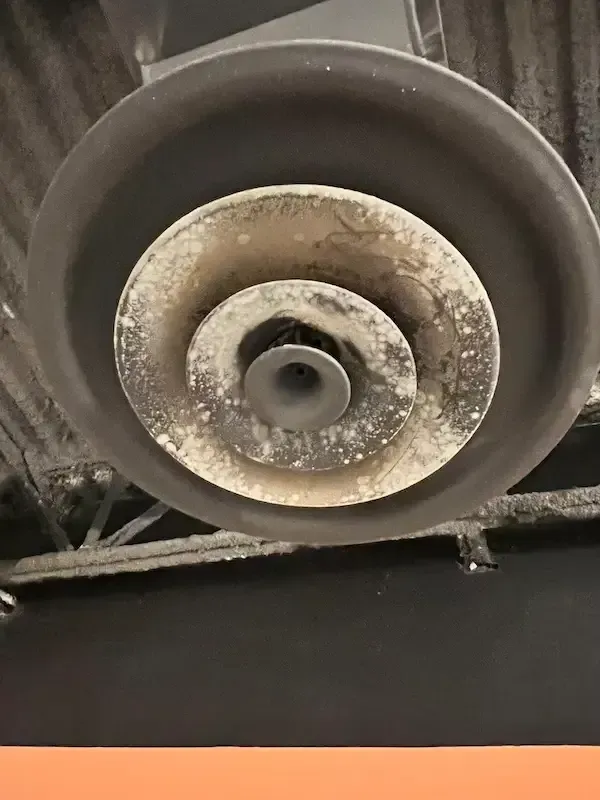

Mold is a common issue in Florida due to the humid climate and frequent storms. It can cause serious health problems and structural damage if not addressed promptly. Homeowner's policies typically cover mold damage if it results from a covered peril, such as a burst pipe or storm-related water intrusion. However, many policies have strict limits on coverage amounts and conditions.

Understanding the source of mold damage is crucial for insurance claims. For instance, mold resulting from neglect or deferred maintenance is usually not covered. Mold Masters recommends regular inspections and maintenance to prevent mold growth and limit potential damage.

Maximizing Your Insurance Coverage

To maximize your insurance coverage, it's essential to regularly review and update your policy to reflect any changes in your home or lifestyle. This includes renovations that increase your home's value or purchasing high-value items that need additional coverage. Keeping a detailed inventory of your belongings can also simplify the claims process if you experience a loss.

In the event of damage, document everything thoroughly. Take photos and keep receipts for repairs and any additional living expenses incurred. This documentation will support your insurance claim and ensure you receive the compensation you're entitled to.

Choosing the Right Insurance Provider

Selecting the right insurance provider is as important as choosing the right coverage. Consider the provider's reputation, customer service, and claims process. Reading reviews and asking for recommendations can provide valuable insights. It's also beneficial to compare quotes from multiple providers to ensure you're getting the best coverage at a competitive price.

Mold Masters' Role in Supporting Homeowners

Mold Masters is committed to helping Florida homeowners navigate the complexities of mold damage and insurance claims. Our team of experts can assist you in understanding your policy, filing claims, and ensuring your home is properly remediated to prevent future mold growth.

We offer professional mold inspections, remediation, and air quality testing to keep your home safe and healthy. Our services adhere to the National Association of Environmentally Responsible Mold Contractors (NAERMC) and the Institute of Inspection Cleaning and Restoration Certification (IICRC) guidelines, ensuring the highest standards of quality and efficiency.

Protect Your Home with Mold Masters

Understanding home insurance is a crucial step in protecting your investment and ensuring peace of mind. Mold Masters is here to support Florida homeowners with expert advice and top-notch mold remediation services. If you're concerned about mold or need assistance with an insurance claim, don't hesitate to reach out.

Secure your home against mold and other potential threats by contacting Mold Masters today. Our experienced team is ready to provide the guidance and services you need to keep your property safe and sound. Let us help you navigate the intricacies of home insurance and ensure your home remains a haven for you and your family. For additional support,

get in touch with us online or call one of our Florida locations: North at

904-397-4030, Central at

813-606-6668, or South at

239-961-9995.